Can students still pay their own way through college?

© Randy Olson for The Atlantic

© Randy Olson for The Atlantic

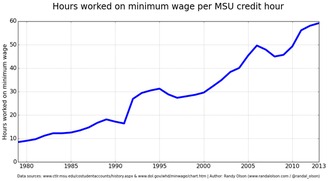

Using a number of metrics, the article explores the relationship between students who worked part-time or full time during the summer or academic year to fund their college tuition at public institutions in the past and the feasibility of students doing the same today. For instance, according to Narula, MSU calculates tuition by the ‘credit hour,’ the term for the number of hours spent in a classroom per week. Many colleges across the United States use this same metric, according to which rising tuition cost at MSU looks something like this: A credit hour in 1979 at MSU was $24.50, adjusted for inflation that is $79.23 today. One credit hour today costs $428.75. Bear in mind that most courses usually entail between two and four credit hours. Therefore, full-time enrollment usually requires a credit load of approximately 12 credit hours. This would have cost a total of $294 for a semester in 1979, and would come to $5,145 today.

After analysis of the rise in tuition costs and rise in the federal minimum wages during the same period, the conclusion is that it is nearly impossible for a full time student to fund his or her own education solely through full time employment throughout the summer and academic year. Of course, the research holds a number of variables constant, so the picture may change somewhat when the cost of private higher education and jobs paying more than federal minimum wage are taken into consideration, as well as the additional costs of room and board. Nonetheless, the sad truth remains that today, it is extremely difficult for a student to fund his or her own higher education without financial assistance from family, moderate to high interest student loans, or both.